Trade Opportunities between Bangladesh and Brazil

Md. Joynal Abdin

Founder & Chief Executive Officer, Trade & Investment Bangladesh (T&IB)

Editor, T&IB Business Directory; Executive Director, Online Training Academy (OTA)

Secretary General, Brazil Bangladesh Chamber of Commerce & Industry (BBCCI)

Bangladesh and Brazil, two dynamic emerging economies, have been deepening their trade and economic engagement in recent years. Bilateral trade has grown significantly, reaching around $2.7 billion in 2024[1]. However, the trade balance is heavily in Brazil’s favor, with Bangladesh importing large volumes of commodities from Brazil and exporting a much smaller amount in return[1]. This imbalance underscores a vast untapped potential for Bangladesh to expand its exports and for both countries to diversify their trade portfolios. Recent high-level visits including the first-ever Brazilian Foreign Minister visit to Dhaka in 2024 and business events such as the Made in Bangladesh trade expo in São Paulo have signaled a mutual commitment to boost commerce. As Brazil’s economy (GDP $2.18 trillion) is about five times larger than Bangladesh’s (GDP $450 billion)[2] and both countries enjoy large consumer bases, strengthening trade ties offers significant opportunities for exporters and investors from both nations. In this article, we examine the sectors with the highest potential for Bangladesh-Brazil trade, current trade patterns, and strategic steps for businesses and policymakers to capitalize on these opportunities.

Current Bilateral Trade Overview

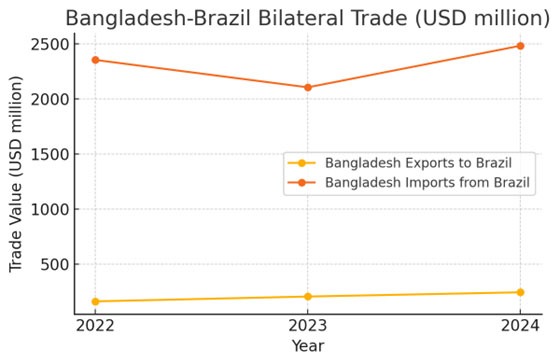

Bangladesh-Brazil trade has grown steadily, albeit from a low base, and is characterized by complementary exchange of goods. In 2024, Bangladesh’s exports to Brazil reached approximately $242 million, while imports from Brazil were about $2.48 billion[1]. Figure 1 below illustrates this recent trend, highlighting Bangladesh’s persistent trade deficit with Brazil. Bangladesh’s exports have risen each year from about $160 million in 2022 to $204 million in 2023, and further to $242 million in 2024 even as imports from Brazil fluctuated with global commodity prices[1]. Overall trade volume in 2024 ($2.73 billion) was about 18% higher than the previous year, reflecting growing engagement.

Figure 1: Bangladesh’s exports to Brazil vs. imports from Brazil (2022–2024), in USD millions. Bangladesh faces a large trade deficit, as imports (mainly commodities) far outpace its exports.

Major exports from Bangladesh to Brazil consist overwhelmingly of manufactured goods, especially ready-made garments. In FY2024-25, Bangladesh exported around $187 million worth of goods to Brazil, a 26% increase over the previous year[3][4]. The key export items are apparel products jerseys, pullovers, cardigans, shirts, trousers, jackets, etc. which together account for the majority of Bangladesh’s export earnings from Brazil[5]. This is not surprising, as Bangladesh is the world’s second-largest apparel exporter after China[6]. Beyond garments, Bangladesh’s other exports to Brazil are relatively limited but include textiles, jute and jute goods, leather footwear, and pharmaceuticals, among others[7]. These non-apparel categories remain small in value but represent areas for potential growth to diversify the export basket[8].

Major imports by Bangladesh from Brazil are dominated by agricultural and mineral commodities. Brazil exported about $2.66 billion in goods to Bangladesh in FY2023-24, up from $2.59 billion the year before[9]. The top import items include:

- Cane sugar and sugar products: Brazil is one of the world’s largest sugar producers, and cane sugar constitutes the single biggest import from Brazil, fulfilling Bangladesh’s domestic demand for sweeteners[10].

- Raw cotton: Bangladesh is the world’s second-largest cotton importer (feeding its textile industry), and Brazil (a top cotton producer) has become a key supplier[11][12]. In 2023-24, Brazilian cotton exports to Bangladesh continued to rise, cementing Brazil as an important source of quality cotton fiber.

- Soybeans and oilseeds: Bangladesh imports substantial quantities of soybeans (for animal feed and edible oil production) and soybean oil. Brazil, a global soybean powerhouse, supplies these vegetable products to Bangladesh[9]. Other grains like maize (corn) are also imported for Bangladesh’s poultry and aquaculture feed industries.

- Edible oils and fats: In addition to raw soybeans, Brazil exports soybean oil and other vegetable oils to Bangladesh[13][14], complementing supplies from Argentina and Southeast Asia.

- Other commodities: Smaller import categories include iron and steel (Brazilian steel and metal products for Bangladesh’s construction sector), animal hides/leather, and chemical products[15][16]. Brazil’s resource-rich economy thus provides many raw materials vital for Bangladesh’s industries.

This pattern of trade reveals a classic complementarity: Bangladesh primarily exports manufactured goods (especially apparel) to Brazil, while importing primary commodities and inputs for its economy. It also highlights the scope for more balanced trade. Both governments have recognized this and are working to facilitate greater exchange. Notably, there is no free trade agreement (FTA) in force yet between Bangladesh and Brazil (or MERCOSUR), meaning trade currently occurs under standard WTO tariffs. Bangladeshi apparel entering Brazil faces high import duties (often around 25–35% under MERCOSUR’s common external tariff), reducing price competitiveness. Likewise, some Brazilian goods face tariffs or regulatory hurdles in Bangladesh. To address this, the two countries have expressed interest in a Preferential Trade Agreement (PTA). In April 2024, Brazil’s Foreign Minister welcomed Bangladesh’s proposal to initiate a MERCOSUR–Bangladesh PTA, seeing it as a way to “enhance business opportunities and foster private sector engagement”[17][18]. Accelerating such trade negotiations is considered crucial, especially as Bangladesh approaches graduation from Least Developed Country (LDC) status in 2026 and will need new trade arrangements to maintain market access[19].

In addition to tariffs, there are other barriers and facilitators to note. The geographical distance and lack of direct shipping or flight routes mean higher logistics costs and transit times for bilateral trade. Financial transactions have also been an issue for example, opening Letters of Credit for Bangladesh-Brazil trade can be cumbersome[20]. To tackle this, officials have discussed easing banking procedures and even exchanging currency arrangements. In mid-2025, Brazil’s Central Bank president and Bangladesh’s ambassador in Brasília met to discuss a trade and economic agreement, including steps to reduce mutual tariffs and ease financing challenges for traders[21][20]. Such efforts, along with growing people-to-people ties (an estimated 7,000–8,000 Bangladeshis now reside in Brazil)[22], are laying the groundwork for a more robust trade relationship.

Apparel and Textiles: A High-Growth Opportunity

Ready-made garments (RMG) are Bangladesh’s flagship export globally, and they also dominate its shipments to Brazil. With Brazil being Latin America’s largest economy and boasting a sizeable consumer market, there is strong potential for Bangladeshi apparel to capture a larger share. In 2022, Brazil imported about $5.9 billion worth of textiles and clothing[23]. Bangladesh’s exports were only around $150 million of that (roughly 2.5% market share), indicating plenty of room to grow[23]. The product mix Bangladesh currently sends – e.g. cotton trousers, T-shirts, shirts, jackets, and knitwear aligns well with Brazilian consumer needs for affordable, quality apparel. In fact, Bangladeshi exports to Brazil surged by nearly 60% in 2022-23[24], demonstrating how quickly this market can expand when demand and pricing align.

Key factors driving opportunity in apparel:

Rising Brazilian Demand: Brazil’s growing middle class and fashion industry result in steady demand for imported apparel, especially at competitive price points. Bangladeshi manufacturers, known for cost-efficient large-scale production, are well positioned to meet this demand with products ranging from basic knitwear to value-added garments.

Competitive Advantage: Bangladesh’s strength in apparel (second globally after China)[6] means it can offer a wide variety of garments, often benefiting from economies of scale and an integrated supply chain. Brazilian buyers have taken note of the “outstanding” quality-to-price ratio of Bangladeshi textiles[25][26] as evidenced by new sourcing deals initiated during the 2025 São Paulo expo. For example, Brazilian clothing importers at the expo began negotiations with Bangladeshi RMG manufacturers after seeing the product range[27].

Raw Material Linkages: Interestingly, this sector also benefits from a complementary reverse flow: Brazil’s raw cotton. Bangladesh’s apparel industry relies heavily on imported cotton, and Brazil one of the world’s top cotton exporters has steadily increased cotton shipments to Bangladesh[11]. Strengthening this supply chain integration (Brazilian cotton -> Bangladesh textiles -> finished apparel back to Brazil) can be mutually beneficial. It ensures Bangladesh reliable raw material sourcing, and Brazil gains a customer for its cotton as well as a source of affordable finished garments for its consumers.

Trade Policy Improvements: A major enabler for apparel trade would be reducing tariffs. As industry experts note, securing an FTA or PTA with Brazil/MERCOSUR could significantly boost Bangladesh’s apparel exports[19]. Lower duties would make Bangladeshi clothing more price-competitive in Brazil’s retail market. Additionally, streamlining customs procedures and standards recognition (e.g. accepting testing certifications) would ease entry for Bangladeshi textiles.

Prospects: If current growth trends continue, Brazil could become one of Bangladesh’s major non-traditional export markets for apparel. Bangladeshi exporters are advised to actively engage with Brazilian buyers through trade fairs and direct marketing. Product diversification could help as well for instance; Bangladesh might explore niche segments like sportswear or sustainable fashion (leveraging its growing compliance with green manufacturing) to appeal to Brazilian consumers. On the flip side, Brazilian textile firms could consider outsourcing or investing in Bangladesh to capitalize on its manufacturing prowess. For example, a Brazilian brand or retailer might set up a sourcing office or even joint venture in Bangladesh’s garment industry to secure a stable supply of goods. Such collaborations can create win-win outcomes, marrying Brazilian market knowledge with Bangladeshi production strength.

Agriculture and Agribusiness: Feeding Complementary Needs

Agriculture is a cornerstone of Brazil’s export economy and an area of critical importance for Bangladesh’s food security and industrial inputs. This sector presents some of the clearest complementarities between the two countries, with Brazil’s vast agricultural surplus meeting Bangladesh’s large import needs, and vice versa for select products.

Brazil’s agricultural exports to Bangladesh already form the bulk of bilateral trade. Key items include:

- Sugar: Brazil is the world’s largest sugar exporter, and Bangladesh is a major sugar importer. In 2021-22, for example, Brazilian sugar (both raw and refined) made up a significant portion of the $2.24 billion exports to Bangladesh[10]. As Bangladesh’s domestic sugar production is limited, Brazilian cane sugar will likely remain a critical import to keep prices stable in Bangladesh’s food market. Ensuring long-term contracts or strategic stock arrangements with Brazil could help Bangladesh avoid sugar shortages and price spikes.

- Grains and Oilseeds: Brazil’s dominance in soybeans and soybean oil nicely complements Bangladesh’s needs for protein meal (for poultry/fish feed) and edible oil. Additionally, Brazil’s large maize (corn) harvest can contribute to Bangladesh’s feed grain imports. By sourcing from Brazil, Bangladesh diversifies away from over-reliance on any single country for staples like oil and feed. This proved useful when global supply chains were disrupted having Brazil as a supplier offers resilience. There is potential to expand imports of other crops like wheat if Brazil increases output or re-exports from the region.

- Livestock Products: One emerging area is meat and livestock. Brazil, a top beef and poultry exporter, has shown interest in the Bangladeshi market. During the 2025 Dhaka expo, Brazilian officials noted efforts to obtain required certifications to export Brazilian beef to Bangladesh[28]. Given Bangladesh’s majority-Muslim population, demand for halal meat is high; Brazil’s halal-certified beef could find a niche, especially in urban markets, if priced competitively. Bangladesh currently imports limited quantities of meat (mostly from South Asia/Australia), so Brazilian beef and poultry would introduce a new supplier and possibly lower prices.

Meanwhile, Bangladesh’s agricultural exports to Brazil are relatively modest but have strategic potential. Bangladesh is a leading producer of jute, an eco-friendly fiber, and has a variety of agro-processed products that could appeal to Brazilian importers seeking diversity. For instance:

- Jute and Jute Goods: With sustainability becoming a global priority, Bangladesh’s jute products (like jute bags, yarn, and geo-textiles) could find a market in Brazil as alternatives to plastic packaging. In fact, a joint venture in sustainable packaging was proposed at the São Paulo expo between a Bangladeshi jute goods exporter and a Brazilian agri-startup[26][29]. The idea is to use jute packaging for Brazil’s agricultural exports, such as coffee or cocoa, thus adding value to Bangladeshi jute and helping Brazilian agribusiness go green. This kind of collaboration showcases how agricultural trade isn’t just about food commodities, but also related value-chain industries.

- Agro-processed Foods: Bangladesh’s food processing companies are growing, producing items like tea, snacks, dry foods, and spices. While Brazil has its own food industry, there may be niche demand in ethnic/specialty stores (e.g. for Bangladeshi tea or spices used in South Asian cuisine). These volumes would be small initially, but they contribute to export diversification.

- Fisheries: Bangladesh is one of the world’s largest inland fish producers[6], known for products like shrimp (a major export globally). Brazil’s market for shrimp or fish is largely self-sufficient or served by Latin neighbors, but specific high-quality products (like freshwater prawn or Hilsa fish from Bangladesh) could be tested in niche markets such as diaspora communities.

Beyond the trade in goods, agricultural cooperation can yield mutual benefits. Brazil’s advanced agri-technology from tropical crop research to livestock breeding could be shared with Bangladesh to boost its productivity. The two governments have agreed to increase cooperation in agriculture and livestock technologies[30], which could involve knowledge transfer, training, or joint research. For example, Brazilian expertise in tropical soybean cultivation might help Bangladesh expand its domestic oilseed production, while Bangladesh’s experience in high-yield rice could be of interest to Brazil’s agricultural scientists. Exchange of agricultural best practices and investment in agro-industrial projects (like food processing plants or cold storage in Bangladesh, possibly with Brazilian partnership) are other avenues. For businesses, this means there are opportunities not only in trading commodities but also in agricultural services and investments such as farm mechanization equipment, irrigation solutions, and agro-fintech (credit for farmers), where Brazilian firms have experience.

Pharmaceuticals and Healthcare Collaboration

The pharmaceutical sector is a promising frontier for Bangladesh-Brazil trade, given Bangladesh’s emergence as a producer of quality generic medicines and Brazil’s large healthcare market. Bangladesh has steadily expanded its pharmaceutical industry over the past two decades, now exporting generic drugs to more than 100 countries. Pharmaceuticals are one of Bangladesh’s “globally competitive sectors”[31], and the government actively promotes pharma exports as part of its diversification beyond garments. Brazil, on the other hand, has a robust domestic pharma industry but still relies on imports for various generic and specialty drugs to meet its huge population’s needs.

Why pharma trade/cooperation makes sense:

Cost-Effective Generics: Bangladesh’s pharma companies specialize in affordable generic medicines – from antibiotics to insulin often leveraging relaxed patent restrictions (as an LDC) to produce licensed generics. These could help lower healthcare costs in Brazil if they meet Brazilian regulatory standards. A Bangladeshi pharmaceutical firm has already signed a distribution MoU with a São Paulo-based health distributor during the 2025 expo[26], initiating the process for regulatory approval in Brazil. This indicates Brazilian importers are interested in Bangladeshi medical products, recognizing their quality and competitive pricing.

Vaccines and Biotech: Both countries have capabilities here Brazil’s institutes (like Fiocruz/Butantan) are renowned for vaccine production, while Bangladesh is building vaccine manufacturing capacity too. Collaboration in vaccine development or distribution could be mutually beneficial, especially for public health programs or pandemic response in the Global South.

Medicinal Raw Materials: Brazil’s vast biodiversity and chemical industry produce many pharmaceutical raw materials (such as APIs Active Pharmaceutical Ingredients). Bangladesh currently imports most API for its drug manufacturing. Brazilian suppliers of certain APIs or pharmaceutical chemicals might find a market in Bangladesh’s formulation industry. Conversely, as Bangladesh develops its own API production (some companies have begun exporting APIs), they could cater to Brazilian manufacturers.

Challenges and steps: Entering Brazil’s pharma market requires navigating the regulatory environment. Brazil’s health authority (ANVISA) maintains high standards for drug registration. Bangladeshi companies will need to invest in compliance, documentation, and possibly clinical trials or certifications to meet these standards. Policymakers could assist by signing mutual recognition agreements in pharmaceuticals testing or fast-tracking approval for drugs that are already WHO pre-qualified or approved in other major markets. It’s encouraging that during the April 2024 visit, Brazil’s foreign minister specifically visited leading Bangladeshi pharmaceutical facilities (Square Pharmaceuticals and Beximco Pharma)[32]. This high-profile visit signals Brazil’s openness to incorporating Bangladeshi pharma products and possibly fostering joint ventures. We may see Bangladeshi pharma firms partnering with Brazilian counterparts to produce drugs locally (Brazil might offer incentives for local production). Such joint ventures or technology transfers can help both sides – Brazil gets investment and knowledge from a cost-efficient producer, and Bangladesh’s firm gains a foothold in a new market.

Healthcare Services: Beyond medicines, healthcare services is another area for collaboration. Brazil and Bangladesh could encourage exchange programs for medical professionals, joint research in tropical diseases, or investment in healthcare facilities. For instance, Brazilian healthcare companies might explore investing in hospitals or clinics in Bangladesh, especially as the country’s middle class grows and demands better health services. Likewise, Bangladeshi medical technology startups (for telemedicine or health IT) could find partners in Brazil’s health sector. While these are longer-term and more indirect trade opportunities, they contribute to a stronger economic partnership.

Energy and Natural Resources

Energy is a critical sector for both countries Brazil is rich in energy resources, and Bangladesh faces a rising energy demand to fuel its growth. Trade and cooperation in energy can take several forms, from exchanging fuel commodities to sharing technology and investment in projects.

Hydrocarbons and Biofuels: Brazil is a significant producer of oil (from its pre-salt offshore fields) and has world-leading expertise in biofuels, particularly ethanol from sugarcane. Bangladesh, conversely, is a net importer of fuels it imports crude oil, refined petroleum, LNG (liquefied natural gas), and coal to meet its energy needs. While historically Bangladesh’s oil imports have come from the Middle East, there is potential to diversify sources. Brazilian crude oil could be an option, especially as Brazil’s output grows; Bangladeshi refineries could process suitable grades of Brazilian crude. More interestingly, ethanol presents a green energy trade opportunity. Bangladesh could import Brazilian ethanol to blend with gasoline, helping to cut costs and reduce emissions. Brazil’s ethanol is competitively priced and Bangladesh already has some policies to blend ethanol in transport fuel. The Brazilian ambassador in Dhaka highlighted energy transition cooperation, which likely includes such biofuel collaboration[33]. Additionally, Brazil’s experience in biodiesel (from soy) might inform Bangladesh’s efforts to develop alternative fuels.

LNG and Gas: As of now, Brazil is not a major LNG exporter (it consumes most of its gas domestically), but if that changes, Bangladesh which has set up LNG import terminals could consider Brazil as a source. More feasibly, Brazilian companies like Petrobras have expertise in offshore gas exploration. Petrobras historically operated in Bangladesh’s gas fields in the past. Re-engaging Petrobras or other Brazilian energy firms in exploration or development of Bangladesh’s offshore blocks could be revitalized, especially since Bangladesh launched new offshore bidding rounds. Such investment cooperation can be a game-changer for Bangladesh’s energy security if new gas reserves are found. The Basic Agreement on Technical Cooperation signed in 2024 explicitly mentions cooperation in energy transition and climate change[30]. This suggests a focus on renewable energy and sustainable practices.

Renewable Energy: Brazil is a global leader in renewable energy, getting a large share of its electricity from hydropower and also investing in wind and solar. Bangladesh is aiming to expand its renewable energy (solar parks, small hydel, etc.) to meet climate goals. There is scope for Brazilian firms to invest in renewable energy projects in Bangladesh, or at least provide technology/consultancy. For example, Brazilian companies experienced in large hydroelectric dams might assist Bangladesh in developing hydro projects (though Bangladesh’s terrain offers limited big-dam options, micro-hydro or regional projects could be considered). Wind energy in Brazil’s northeast has boomed; Bangladesh’s coastal areas similarly have wind potential that could be explored with Brazilian technical help.

Minerals and Metals: Brazil’s rich mineral resources (iron ore, bauxite, etc.) could also be relevant. Bangladesh’s manufacturing sectors (like steel re-rolling, aluminum industries) typically import raw materials from various sources. While Bangladesh mostly imports steel scrap from nearer sources, there might be niche opportunities to import Brazilian iron ore or semi-finished steel if Bangladesh ever establishes primary steelmaking. On the flip side, fertilizers are a critical import for Bangladesh’s agriculture. Brazil, while a big fertilizer importer itself, has started local production of phosphate fertilizers and potash mining ventures. If Brazilian fertilizer output grows, Bangladesh could be a market (currently it buys a lot from Middle Eastern producers).

In summary, the energy and natural resources domain offers strategic opportunities mostly in knowledge transfer and investment. To capitalize on these, both governments should continue their dialogues on energy cooperation. Businesses in this sector e.g., Bangladesh’s state oil/gas corporation and Brazil’s energy firms should look at joint exploration, sharing best practices in biofuel technology, and possibly setting up pilot projects (like an ethanol plant in Bangladesh using Brazilian know-how, or a solar panel manufacturing collaboration given both country’s solar initiatives). These moves would strengthen energy security for Bangladesh and open a new market for Brazilian energy tech exporters.

Technology, ICT, and Fintech Services

While goods trade forms the bulk of current exchanges, the future of Bangladesh-Brazil economic ties could very well hinge on services and technology collaboration. Both nations have burgeoning tech sectors Brazil is often dubbed the Silicon Valley of Latin America with a thriving startup ecosystem (particularly in fintech and e-commerce), and Bangladesh is fast emerging as a tech outsourcing and digital innovation hub in South Asia. There are several avenues to explore in this domain:

- ICT Outsourcing and Digital Services: Bangladesh’s IT and IT-enabled service (ITES) sector has grown rapidly, exporting software, mobile apps, and business process outsourcing (BPO) services worldwide. Thus far, Latin America has not been a major client region for Bangladeshi IT firms, but that could change. Brazilian companies, especially startups, might find Bangladesh an attractive outsourcing destination for software development or back-office support due to its cost competitiveness and skilled English-speaking workforce. Conversely, Brazilian IT firms could expand to Asia by partnering with Bangladeshi firms to localize their products or leverage Bangladesh as a base for Asian markets. The demand in Brazil for tech solutions from fintech software to enterprise IT is growing[34], and Bangladeshi providers could help fill that gap remotely. Government support for matchmaking in this sector (for example, trade bodies hosting virtual B2B meets for IT companies) would help break the ice.

- Fintech Collaboration: Fintech is a standout area of mutual strength. Brazil has achieved global recognition for its fintech revolution (consider the success of digital banking platforms and the PIX instant payments system that has transformed transactions in Brazil), while Bangladesh is known for its leading mobile financial service platforms (e.g., bKash) that brought millions into the formal financial system. Both countries can learn from each other’s experiences in financial inclusion and digital payments. There is opportunity for cross-investment: a Brazilian fintech scaling globally might invest in or partner with a Bangladeshi mobile money operator, or a Bangladeshi fintech startup might adapt a Brazilian solution for its market. Additionally, policy dialogues on fintech regulation (Brazil’s central bank has been very progressive; Bangladesh Bank is also fostering digital payments) could ensure that, in the future, remittances or transactions between the two countries become smoother and cheaper. For instance, enabling interoperability between payment systems or using blockchain for trade finance between the two countries are forward-looking ideas.

- Startups and Innovation: Both governments have signaled interest in science, technology and innovation cooperation[30]. This broad area includes research collaboration (e.g., joint R&D in biotechnology, agricultural tech as mentioned earlier, or even aerospace Brazil has a space program and Bangladesh launched its own satellite). On a commercial level, fostering connections between startup ecosystems could yield long-term partnerships. Brazilian venture capital might find promising tech startups in Bangladesh’s growing market of 170 million people, and Bangladeshi investors could also look at Latin America via Brazil. Events like innovation forums or startup exchange programs (perhaps under a technical cooperation MoU) would be useful.

- Education and Skill Development: A crucial aspect of tech collaboration is human capital. Expanding student and academic exchanges in STEM fields can underpin future trade in tech. Scholarships for Bangladeshi students in Brazilian universities (and vice versa) would create a pool of bi-cultural professionals who understand both markets. Over time, these individuals often become bridge-builders in trade and investment. Additionally, language training (Portuguese in Bangladesh, English in Brazil or even Bengali) can be encouraged for those interested in working in the other country’s market. Improved language skills would directly help service trade, as communication is key in IT/BPO and other professional services.

In essence, the technology and services sector, though not yet a major component of Bangladesh-Brazil trade, holds strategic importance. It represents the future growth areas that can supplement the trade in traditional goods. Exporters and entrepreneurs in both countries should keep an eye on these trends for example, a Bangladeshi company providing fintech software could target Brazilian banks as clients, or a Brazilian e-commerce firm could source affordable IT support from Bangladesh. Governments can facilitate this by including services in any trade agreements (e.g., easing visa issuance for IT professionals, recognizing each other’s professional certifications, protecting intellectual property jointly). As digital trade grows globally, Bangladesh and Brazil can benefit by connecting their digital economies.

Investment and Policy Recommendations

To translate the above opportunities into reality, concerted action is needed by both businesses and policymakers. Below are targeted recommendations:

For Exporters and Businesses

- Market Research and Entry Strategy: Exporters in both countries should invest in understanding each other’s markets. This means studying local consumer preferences, standards, and regulatory requirements. For Bangladeshi companies, hiring a Portuguese-speaking agent or distributor in Brazil can greatly ease market entry. Brazilian firms looking to source from or invest in Bangladesh should similarly engage local partners or the Brazil-Bangladesh Chamber of Commerce for guidance.

- Leverage Trade Promotion Platforms: Proactively participate in trade fairs, expos, and B2B matchmaking events. The Made in Bangladesh Expo 2025 in São Paulo demonstrated the impact of such platforms numerous deals and partnerships (in garments, pharma, jute products, etc.) were initiated as a direct result of face-to-face interactions[35][26]. Businesses should capitalize on future editions of this expo and similar events (e.g., Brazilian trade shows in textiles or food where Bangladeshi firms could exhibit). These events also build trust and familiarity, which are vital for long-term business.

- Diversify Product Offerings: Bangladeshi exporters should look beyond their primary products to niche and value-added goods that could appeal to Brazil. For instance, garment makers could explore exporting high-end apparel or technical textiles, not just basic wear. Jute goods manufacturers can design innovative lifestyle products for Brazil’s eco-conscious consumers. Likewise, Brazilian exporters to Bangladesh might find opportunities in offering more processed foods (fruit juice, dairy products), consumer goods, or industrial inputs that Bangladesh currently procures from elsewhere. Diversification will also help narrow the trade gap.

- Quality and Compliance: Both markets have their specific standards e.g., Bangladesh’s pharmaceutical exports must meet Brazil’s health regulations, and Bangladeshi food imports from Brazil should meet halal and safety standards. Businesses must ensure strict compliance and obtain necessary certifications (such as ANVISA approval for drugs, or halal certification for meats) to avoid non-tariff barriers. Investing in quality will pay off in building a good reputation.

- Joint Ventures and Local Presence: Companies should consider establishing a local presence through joint ventures or representative offices. A Bangladeshi apparel company, for example, might set up a small finishing or distribution center in Brazil to better serve customers and bypass certain tariffs by doing final processing locally. A Brazilian agribusiness firm could invest in food processing or storage facilities in Bangladesh (where their commodities are consumed) to move up the value chain. These investments can also benefit from any local incentives (such as Bangladesh’s export processing zones or Brazil’s industrial free zones).

- Networking and Diaspora Engagement: The Bangladeshi diaspora in Brazil, though small, is growing[22] and can be a valuable network for market insights and connections. Exporters should engage diaspora business associations or informal networks for instance, Bangladeshi entrepreneurs in São Paulo or Rio may already be involved in import businesses or retail and can help newcomers navigate the Brazilian market. Similarly, Brazilian companies can tap into Brazil’s expatriates in Asia or use the Brazil-Bangladesh Chamber and embassies to find reliable partners.

For Policymakers and Trade Officials

- Fast-Track Trade Agreements: Prioritize the negotiation of a Bangladesh–MERCOSUR Preferential Trade Agreement. As noted, both sides have expressed strong interest[17][18]. A PTA or eventual FTA would reduce tariffs on key goods (for example, garments from Bangladesh and select agri-commodities from Brazil), directly boosting trade volumes. Given Bangladesh’s upcoming LDC graduation (2026) and consequent loss of some trade preferences, securing new agreements with major partners like Brazil is strategically important[19]. Policymakers should aim to conclude a basic trade MoU as a stepping stone, ideally during planned high-level meetings in the near term[36].

- Address Banking and Payment Issues: Make bilateral trade financially smoother by resolving Letter of Credit and payment difficulties. The concept paper presented by Bangladesh’s envoy in 2025, which proposed easing L/C opening and possibly currency arrangements, is a good start[20]. Central banks of both countries could explore establishing currency swap lines or allowing trade payments in local currencies (tied to a stable reference) to reduce dependence on third currencies. At minimum, encouraging major banks in Brazil and Bangladesh to set up correspondent relationships will facilitate quicker and cheaper transactions for traders.

- Trade Facilitation and Logistics: Governments should work on reducing bureaucratic red tape and improving connectivity. This includes simplifying customs procedures for instance, adopting electronic document exchange and pre-clearance agreements so that goods face minimal delays at ports. Exploring direct shipping routes or chartered cargo services between South America and South Asia could significantly cut transit times (currently, many shipments are routed via Europe or Middle East). Even a direct flight connection (charter or passenger) between Dhaka and São Paulo/Rio, if viable, would greatly help business travel and cargo (especially for high-value, time-sensitive goods like perishable foods or samples). While direct routes may not be immediately economical, governments can facilitate dialogues between airlines or shipping lines to assess demand.

- Investment Treaties and Incentives: To spur investment, both sides might negotiate a Bilateral Investment Treaty (BIT) or include investment chapters in trade agreements. This can provide protections and confidence to investors. Additionally, offering incentives for strategic joint ventures e.g., tax breaks or special economic zone access for Brazilian firms investing in Bangladesh’s priority sectors (and vice versa) could attract capital flow. Bangladesh can invite Brazilian investment in sectors like agro-processing, textiles (e.g., textile machinery or cotton farming in Bangladesh, given Brazil’s expertise), and energy infrastructure. Brazil, likewise, could benefit from Bangladeshi investment in sectors such as textiles (if a Bangladeshi manufacturer sets up in Brazil, creating local jobs) or information technology. High-level business forums should be convened regularly to identify and fast-track such investment opportunities.

- Mutual Capacity Building: As part of the technical cooperation agreement[30], the two governments should foster exchange programs and training that support trade. For example, training Bangladeshi trade officials and quality inspectors on Brazilian standards (and vice versa) will help reduce compliance issues. Sharing knowledge on export promotion, SME support, and trade finance (areas where each country has some best practices) can upgrade the overall trading ecosystem.

- Holistic Engagement Beyond Trade: Finally, a broader relationship strengthens trade in the long run. Initiatives in education, culture, and tourism will indirectly benefit economic ties by building goodwill and understanding. Scholarships, cultural festivals (perhaps a “Brazil week” in Dhaka and a “Bangladesh week” in Brasília), and sports cooperation (Brazil has even mooted an MoU on sports with Bangladesh[37], which could include football training exchanges) all contribute to a favorable environment for business. A growing familiarity will make it easier for a Bangladeshi entrepreneur to travel to Brazil and feel at home doing business, or for a Brazilian company to confidently enter the Bangladeshi market as one of the first movers in Latin Asia trade.

Conclusion

The Bangladesh-Brazil bilateral trade relationship stands at an inflection point. What has historically been a limited exchange (focused on a few commodities and products) is now poised to blossom into a much more comprehensive partnership. The fundamental drivers are in place: Bangladesh’s need for raw materials and new markets dovetails with Brazil’s supply capabilities and interest in affordable manufactured imports. Both economies have complementary strengths one excelling in light manufacturing and the other in agribusiness and resources that create a natural synergy[38]. Moreover, as global trade dynamics shift (with factors like US-EU trade policies and supply chain reorientations), the two countries find strategic value in diversifying their trade links[39][40]. Brazil’s recognition of Bangladesh as a “new economic giant” in South Asia[41] and Bangladesh’s courting of Brazil as a gateway to Latin America underscore a mutual strategic interest.

For exporters and investors, the message is clear: now is the time to engage. Sectors such as apparel, agriculture, pharmaceuticals, energy, and ICT offer fertile ground to build new business lines. A Bangladeshi garment manufacturer, for example, can seize a growing retail market in Brazil, while a Brazilian agritech firm can tap into Bangladesh’s agricultural modernization drive. The success stories are starting to emerge from the Bangladeshi pharma firm entering Brazil to the jute packaging joint venture and Brazilian cotton’s integral role in Bangladesh’s textile value chain[26][38]. These are early indicators of what could eventually be a multi-billion dollar exchange benefiting both sides.

However, realizing this potential will require sustained efforts to remove obstacles and actively promote partnerships. Policy support in the form of trade agreements and trade facilitation will lay the groundwork, but it is ultimately private sector initiative that will drive trade volumes. Companies that act early to build relationships, understand compliance, and adapt products for the local context will have a first-mover advantage. For Bangladesh and Brazil, enhancing this bilateral trade is more than just commerce it is a step toward a stronger South-South cooperation, leveraging each other’s strengths for mutual development[18][42]. With commitment and creativity from both public and private stakeholders, Bangladesh-Brazil trade can transform from a peripheral engagement into a robust economic corridor, enriching exporters, consumers, and economies in both nations.

[1] [2] [13] [14] [15] [16] ns2.dhakachamber.com

https://ns2.dhakachamber.com/storage/bilateral-trades/October2025/HQ6Fz3shEBWxMvYX5kMv.pdf

[3] [4] [5] [8] [9] [10] [11] [12] [19] [22] [23] [24] [38] [39] [40] [41] Bangladesh’s export to Brazil up 26% in FY25 | The Business Standard

https://www.tbsnews.net/economy/bangladeshs-export-brazil-26-fy25-1224566

[6] [7] [31] FBCCI | Meeting on facilitating trade between Bangladesh and Brazil

https://fbcci.org/web/news/meeting-on-facilitating-trade-between-bangladesh-and-brazil

[17] [18] [32] [33] [37] Brazilian FM welcomes Bangladesh’s interest in Preferential Trade Agreement | bilaterals.org

https://www.bilaterals.org/?brazilian-fm-welcomes-bangladesh-s

[20] [21] [36] [42] [43] Brazil wants to ink trade deal with Bangladesh | The Financial Express

https://thefinancialexpress.com.bd/home/brazil-wants-to-ink-trade-deal-with-bangladesh

[25] [26] [27] [28] [29] [34] [35] Made in Bangladesh Expo 2025 Impact – Brazil Bangladesh Chamber of Commerce & Industry (BBCCI)

https://tradeandinvestmentbangladesh.com/made-in-bangladesh-expo-2025-impact/

[30] Bangladesh, Brazil sign agreement to boost ties-Xinhua

https://english.news.cn/asiapacific/20240408/ac7fe4b490a54d7dbf534228e3e9f3cf/c.html